For the last 2 years, it’s been all over the news. There has been a lot of activity within our current White House administration that impacts our national – and global – economy. While much of this activity may be a source for more news articles and debates at the dinner table, it is important to understand how these changes have a direct impact on your own businesses and your income. For any business in the United States, there are two major changes that are happening now that business decision makers should understand:

By understanding the implications of these two government policy changes, businesses can take advantage to minimize costs and maximize their bottom line.

Tariffs

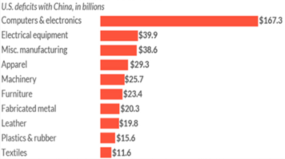

Several months ago, the Trump administration established tariffs against approximately $200 billion on Chinese imports into the United States. A major product segment impacted by these tariffs is one that most of us need and use on a daily basis – IT hardware. This includes critical things that you use to do your work and keep your network running – computers, phones, switches, routers, servers, etc. As you see in the chart on the right, a significant amount of these products are manufactured in China1. In September, a 10% tariff was passed on these products, with an even greater increase anticipated in the future.

Until recently, an additional increase of 25% was expected. However, in December, an announcement was made that will remove this additional rate increase… at least for now. Given the current volatility around these tariffs, IT manufacturers are scrambling to react to minimize the impact. While we have no true idea how the market will react, there is one thing that we can confidently assume – prices are going to change. And they aren’t going down, they are going to go up. So, as 2018 draws to an end and you finalize your 2019 budgets, you should consider these changes, and consider making your purchases for IT products sooner than later.

Corporate Income Tax

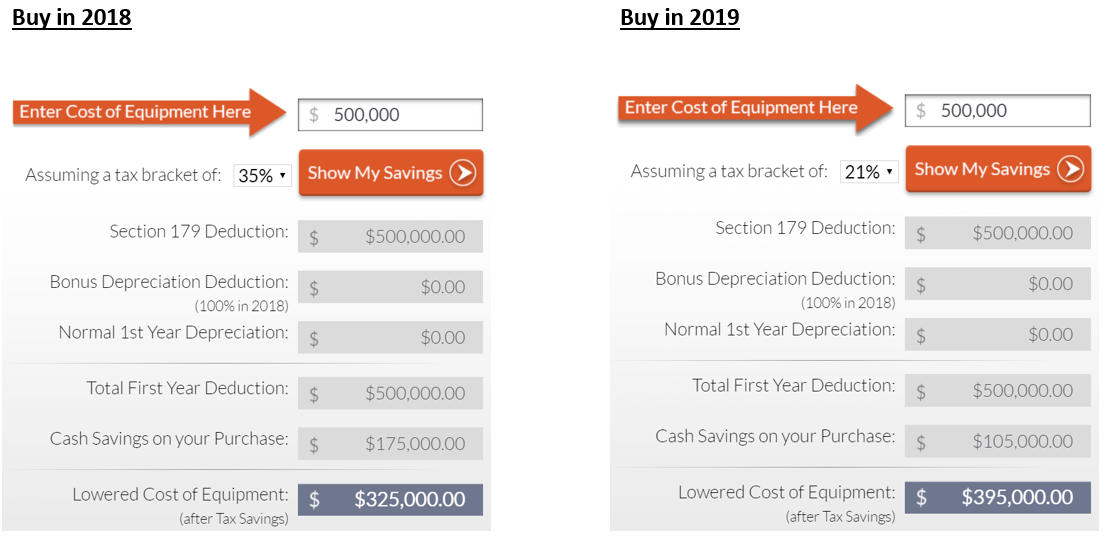

This New Year’s Day, corporate business owners have good reason to break out the champagne, as the tax rate for corporations will drop from 35% to 21%. This change is intended to free up capital to allow organizations to invest more in their growth. This change is nothing but positive for businesses in the U.S. However, there is one program that every business should consider, as it’s affected in a different way by this change. The program that I am referring to is Section 179 of the IRS Tax Code.

Section 179 is a program that has been around for many years – it allows small to medium businesses to fully deduct up to one million dollars ($1,000,000) in expenditures on capital equipment, which includes IT hardware and software. Why is this important? With the tax rate going down, this has the opposite effect on what you can deduct. As the image s below reflects, spending the same amount of dollars on capital expenditures such as IT hardware in 2018 vs 2019 will net your business less, potentially by a significant amount.

What To Do Now

To conclude – these two policy changes by our federal government might be different, but they should elicit the same reactions from smart business buyers. If your business can afford it, you should allocate any forecasted IT spend now before your cost to make capital expenditures goes up next year. If you would like to discuss your options on what would best optimize your business network, please consult with your local Konica Minolta sales professional, or call All Covered, the IT Services Division of Konica Minolta, at 1-866-446-1133.

1 MarketWatch, 19 June 2018, Jeffry Bartash